From Hospitality Concept to Cross-Border Investment Strategy

What defines the current cycle is not simply the growth of branded residential developments, but the breadth of brands and geographies now involved. Alongside established hospitality names, lifestyle, design, and automotive brands are increasingly being integrated into residential real estate.

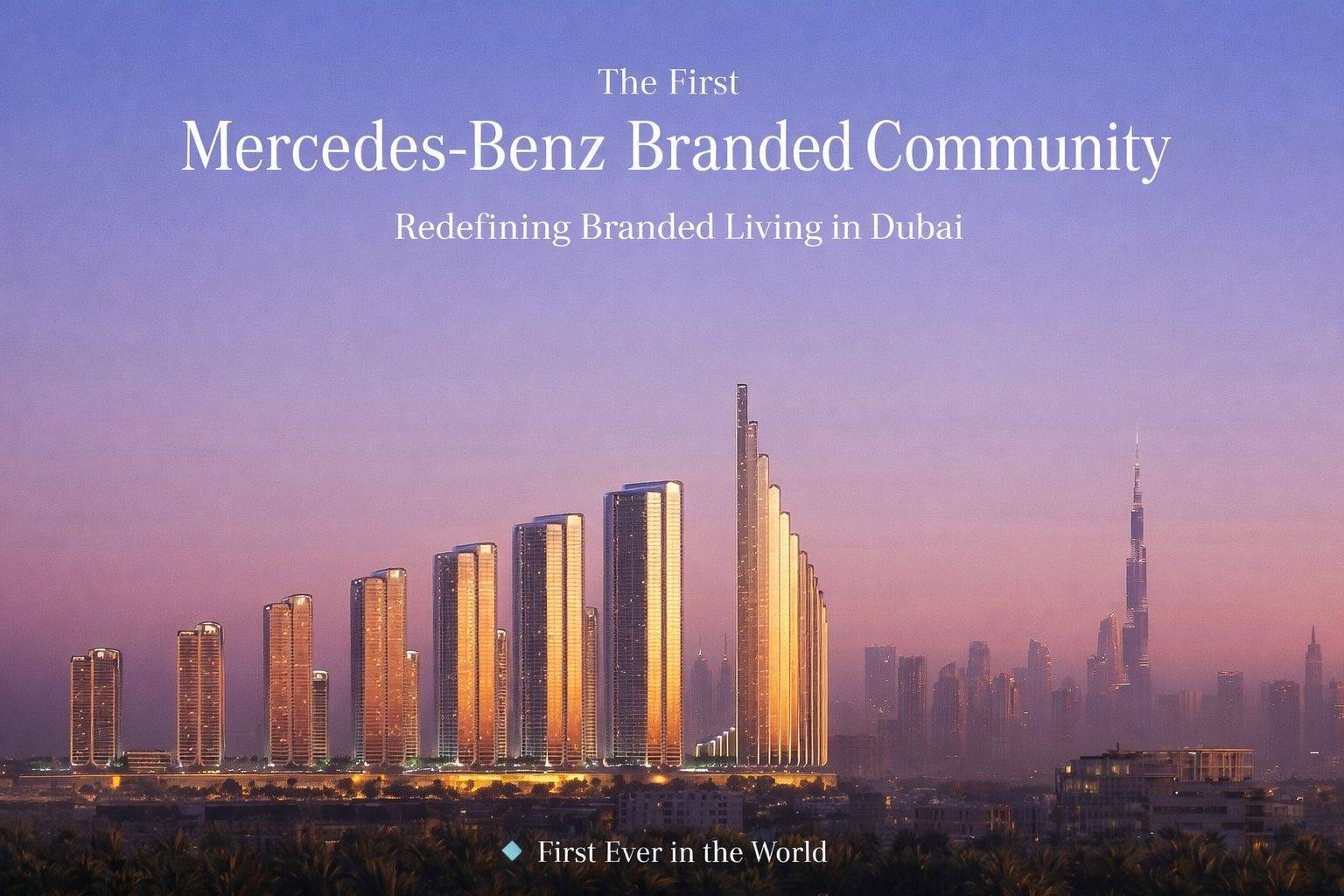

Developments such as Mercedes-Benz Residences in Dubai, W Residences in Manchester, Nobu-branded projects across Manchester and Bali, Nikki Beach in Ras Al Khaimah, and Trump-branded developments emerging in Saudi Arabia illustrate how branding is being used as a strategic signal to international capital. In many cases, the presence of a global brand reflects confidence not just in a single project, but in a city or country's broader real estate trajectory.

Why Branded Residences Appeal to International Investors

Cross-border property investment often involves higher perceived risk, particularly when purchasing off-plan or entering unfamiliar jurisdictions. Branded residences can reduce this friction by offering predictability in design standards, operational quality, and long-term management.

For internationally mobile investors assessing opportunities across multiple markets, brand familiarity provides a consistent reference point. In this context, branding functions less as a status marker and more as a risk-mitigation tool, particularly in markets undergoing transformation or repositioning.

Comparative Market Insight: How Branding Functions Across Global Cities

Although branded residences appear across very different geographies, their investment role follows a similar underlying logic.

In Dubai, branded residences operate within a mature, highly competitive luxury market. Early projects benefited from novelty, but as supply has increased, investor performance has become more closely tied to fundamentals. Developments such as Mercedes-Benz Residences demonstrate how branding has moved beyond hospitality into design-led ultra-prime positioning. At this stage of the cycle, branding enhances value only where it is supported by location quality, developer credibility, and genuine post-completion brand involvement.

In Manchester, branded residential developments such as W Residences and the anticipated arrival of Nobu reflect a city at an earlier, but increasingly international, stage of its investment cycle. Here, branding plays a strategic role in repositioning the city on a global stage, helping attract overseas buyers who may be less familiar with regional UK markets. For investors, branding can support liquidity by widening the potential exit audience beyond domestic demand.

In Bali, Nobu-branded residential concepts operate within a lifestyle-driven investment environment where buyers often balance personal use with rental income. In this context, branding provides reassurance around management standards and operational consistency in a market where quality can vary significantly. For investors, the brand often acts as a proxy for governance and long-term viability rather than pure luxury positioning.

In Ras Al Khaimah, branded developments such as Nikki Beach illustrate how branding can act as a catalyst in an emerging destination. Here, it supports early international awareness and accelerates capital inflows, while requiring careful consideration of long-term demand depth and resale liquidity.

In Saudi Arabia, the emergence of branded residential projects, including Trump-branded developments, signals a market at a strategic early stage. Branding functions as a confidence marker aligned with national transformation initiatives, aimed at attracting foreign investment into newly opening real estate sectors.

Across all these markets, branding delivers the strongest investment outcomes when it reinforces solid fundamentals rather than compensating for their absence.

When Branding Adds Lasting Investment Value

Global market behaviour suggests that branded residences perform most consistently when the brand is meaningfully embedded into the project. This includes influence over architectural design, resident services, operational standards, and long-term management.

In such cases, branding can support stronger resale liquidity, stabilise rental demand, and broaden international buyer appeal. Where branding is superficial, pricing premiums are more vulnerable to erosion as markets mature and buyer sophistication increases.

The Risk of Over-Saturation

As branded residences proliferate globally, investors face an increasing risk of dilution. Not every brand carries equal weight, and not every location benefits equally from branded positioning. In some cases, branding may obscure weak fundamentals rather than enhance strong ones.

This makes selectivity and market knowledge critical.

The Polarius Perspective

At Polarius International Real Estate, we assess branded residences through an investment-first, cross-border lens. Rather than treating branding as a universal advantage, we analyse how it functions within each market cycle - whether supporting liquidity in Dubai, broadening international demand in Manchester, underpinning operational confidence in Bali, or signalling strategic intent in Saudi Arabia.

Brand recognition alone is not an investment strategy. Long-term performance depends on fundamentals, timing, and exit demand. Branded residences are no longer a regional or lifestyle-driven phenomenon. Their expansion across cities as diverse as Dubai, Manchester, Bali, and emerging Saudi markets reflects a broader shift in how international investors approach real estate globally.

As the sector matures, the developments that succeed will be those where branding complements strong fundamentals, credible delivery, and sustained buyer demand.

For investors, the opportunity lies not in following the brand, but in understanding the market behind it.