At Polarius Real Estate, we know that intelligent property decisions are driven by more than instinct - they’re powered by insight.

This section offers our latest perspectives on the forces shaping international luxury real estate, from regional growth trends and investment patterns to the dynamics of high-end rentals and off-market opportunities. Whether you're acquiring a villa on the Côte d’Azur, investing in hospitality assets in Bali or analysing market entry in Abu Dhabi, our insights aim to bring clarity to a complex global landscape.

With real estate offerings across France, Italy, the UAE, the UK, Malta and Indonesia, we combine on-the-ground knowledge with international reach. Our analysis blends economic context, lifestyle considerations, and real-time data from our own transactions - offering a unique view into where the global real estate market is, and where it’s going.

Our Market Insights are designed for serious buyers, investors and real estate professionals who want to go beyond the headlines. You’ll find region-by-region updates on pricing trends, buyer demand, inventory shifts and investment appetite - all curated from our global network and client activity.

We also publish commentary on commercial property movement, hotel and hospitality trends and the growing role of private equity and family office strategies in both on and off-market acquisitions.

For those interested in seasonal opportunities, we provide regular updates on luxury rental markets in the French Riviera, Mykonos and Ibiza - from price fluctuations and occupancy data to guest preferences and lifestyle demand.

Our property insight briefs offer a concise, data-backed overview of the most relevant shifts in global property markets - written for those who value accuracy, discretion and real-world application.

Whether you’re expanding your portfolio, acquiring your next residence, or preparing to sell a prized asset, understanding the market is essential. At Polarius, we don’t just follow trends - we operate within them.

This isn’t theory. It’s what we see on the ground, every day - across listings, negotiations and high-level client transactions. Our goal is to turn that experience into useful intelligence for our clients and partners around the world.

For more news and editorial content, explore our News section, or view our latest media features on the Press page. For bespoke market advice or a tailored investment briefing, please don’t hesitate to get in touch.

Global real estate markets are entering a period where geopolitics is no longer a background consideration, but a primary driver of investment behaviour. Beyond interest rates and inflation, political stability, legal certainty and jurisdictional security are increasingly shaping where international buyers choose to deploy capital.

Political unpredictability in the United States, including abrupt policy signals and election-driven volatility, ongoing conflict in Eastern Europe, and rising geopolitical tensions around strategic regions such as Greenland have reinforced a more cautious and selective investment mindset among high-net-worth individuals and family offices.

In this environment, premium real estate is increasingly viewed as a safe-haven allocation — not purely for yield, but as a mechanism for long-term capital preservation, diversification and protection against geopolitical risk.

For years, Monaco luxury real estate has appeared almost untouchable. Prices per square metre have set European benchmarks, demand has consistently outpaced supply, and the Principality’s reputation as a secure wealth jurisdiction has shielded it from wider volatility. Yet in 2026, a more deliberate pace defines the market. Deals are progressing, but without the urgency that characterised the post-pandemic surge. Negotiations are firmer. Buyers are more forensic.

Has Monaco lost momentum - or is the world’s most expensive property market entering a more disciplined era?

Explore two character-driven hospitality properties for sale in Occitanie — 5 & 7 in Roujan (Hérault) and a former gay chambres d’hôte in Ambax, Haute-Garonne — positioned within Europe’s growing LGBTQ travel market.

Despite global economic uncertainty and more selective buyer behaviour, London real estate continues to stand out as one of the world’s most resilient and internationally sought-after prime residential markets. Demand is not disappearing — it is becoming more focused, more value-driven, and increasingly concentrated in London’s strongest neighbourhoods.

Imagine waking up just steps from the Thames, in a historic dockside setting that blends calm waterside living with the energy of London at your doorstep.

Ransome's Wharf in Battersea offers a rare opportunity to own a home where city life and tranquility coexist effortlessly

In the upper tiers of global real estate, many of the most exceptional opportunities are never publicly advertised. Commonly referred to as off-market listings, off-market properties or off-market real estate assets, these assets are sold quietly, privately, and often only shared with a very select group of qualified buyers.

At Polarius International Real Estate, off-market transactions form a core part of what we do. Increasingly, this includes off-market hotel assets, alongside ultra-prime residential estates and strategic investments worldwide. From discreet villas on the Côte d’Azur to landmark hospitality assets, our role is to act as a trusted gateway to opportunities that simply do not appear on public portals.

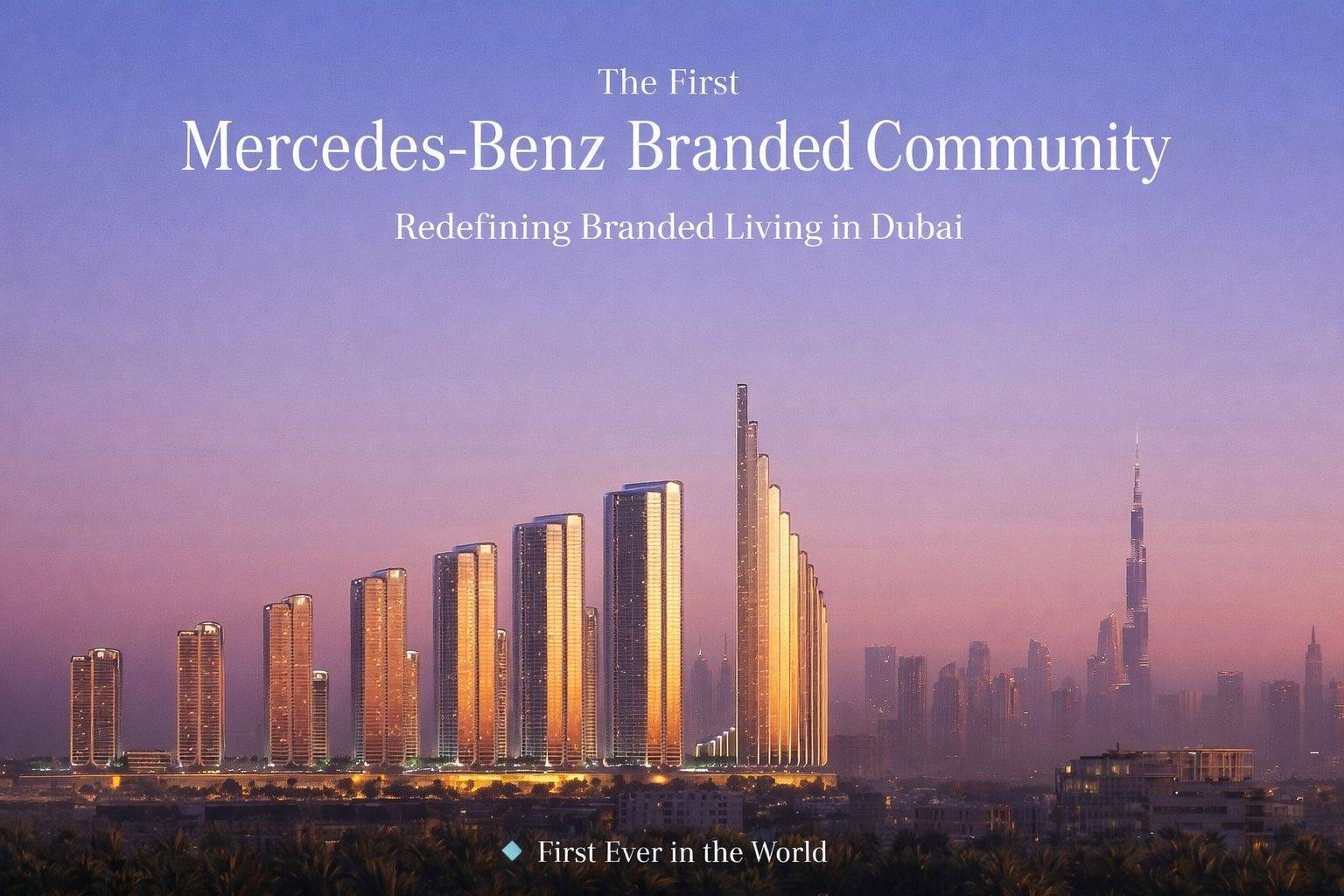

Branded residences have evolved from a niche extension of luxury hospitality into a recognised global real estate asset class. Once concentrated in resort destinations and ultra-prime city centres, they are now appearing across a wider range of international markets, attracting investor interest from the Middle East, Europe, and Asia-Pacific.

For investors, the key question is no longer whether branded residences are here to stay, but where branding genuinely enhances long-term value, liquidity, and exit potential.

A New Phase For The Global Real Estate Market

The global real estate market has entered a new era shaped by international property investment and increasingly sophisticated global property investment strategies. In the luxury property market of 2026, buyers are no longer asking where prices are rising fastest — they are asking where HNWIs are buying to protect capital, secure lifestyle and build a resilient global property portfolio.

Family offices, private investors and internationally mobile entrepreneurs are prioritising wealth preservation properties across multiple jurisdictions rather than concentrating risk in a single country. This is the defining trend behind modern family office real estate strategies, and it is why Polarius operates as a multi-country real estate platform rather than a local agency.

French Alps luxury chalet rentals continue to perform strongly, driven by global demand for privacy, bespoke experiences, and high-quality seasonal accommodation. Courchevel, in particular, remains a benchmark destination, combining limited supply with consistent international appeal. This insight explores how luxury chalet rentals are evolving, why Courchevel continues to command premium values, and what this reveals about wider trends in the global luxury rental market.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.